Our mission is to delve into the world of craft beer from a fresh perspective. We want to find out what makes craft beer so interesting, from the people who make it to the people who buy it. What is the driving force behind creating new and interesting beers? What is it that makes you pick up a bottle off the shelf, or try a new beer at a pub or restaurant?

Explore the site and you will find interviews, art, music, and more. We’ll be adding new content monthly so check back often!

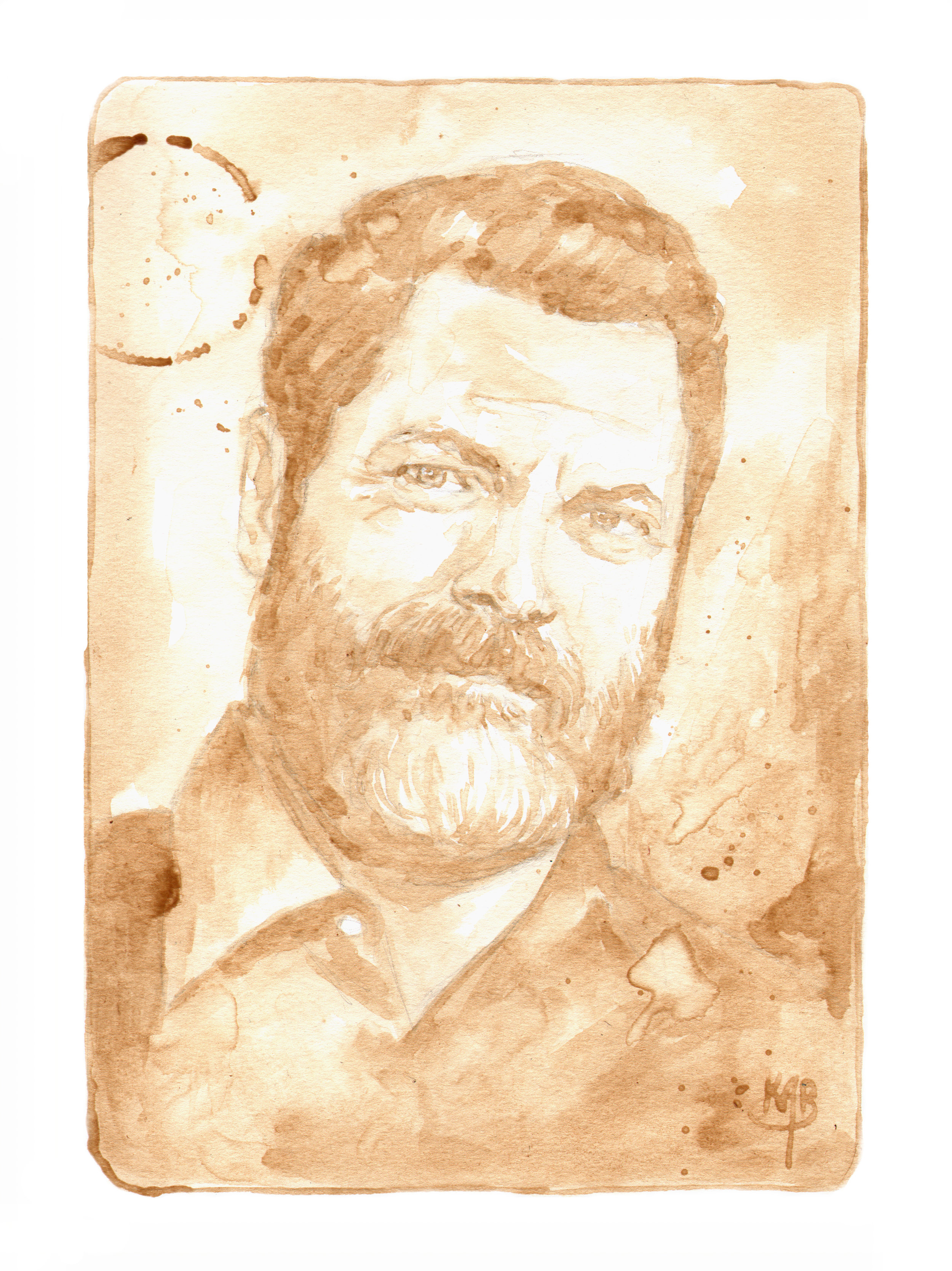

We were featured on Draft Magazine's website. Click through to see an interview with Kyle.

Also, be sure to checkout Beerportraits on Twitter, Instagram and Facebook through the links below.